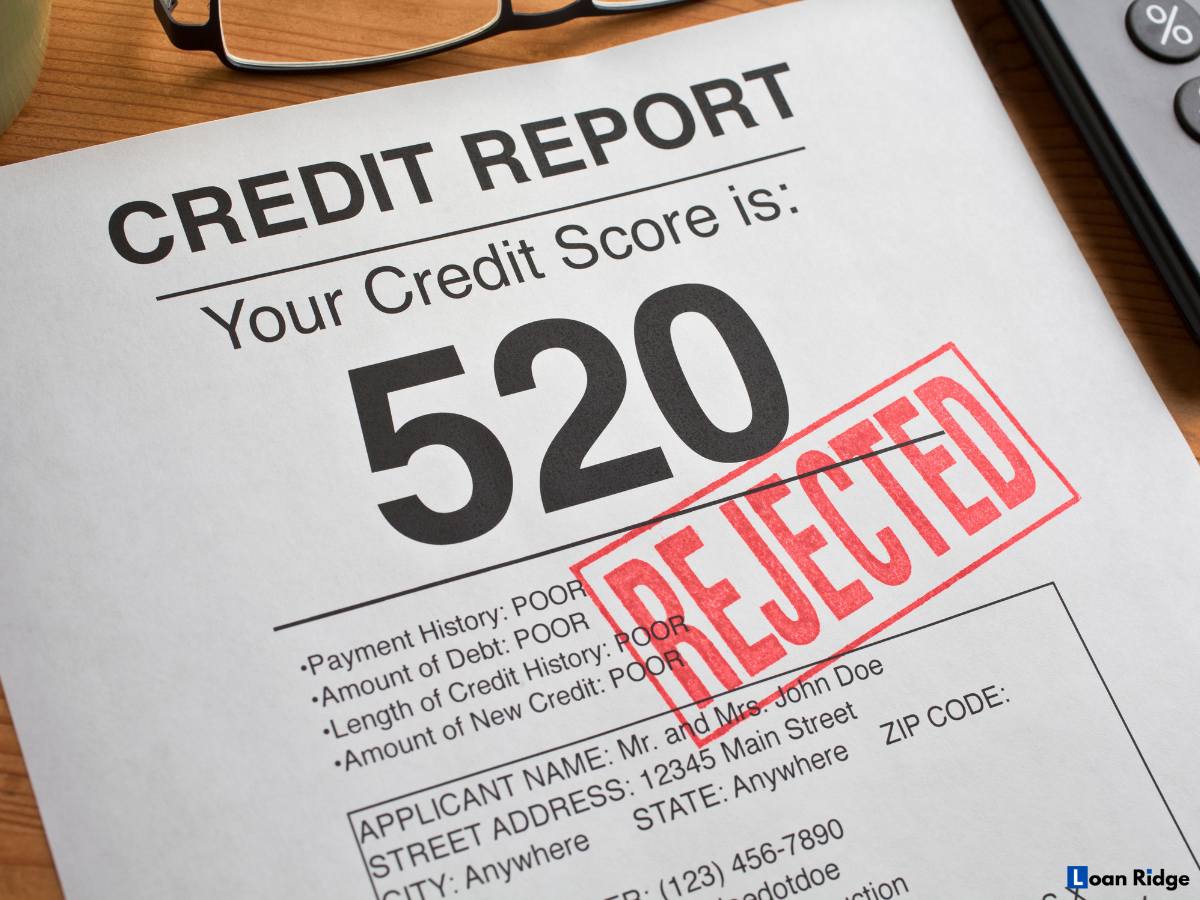

Seniors who have limited income often find it challenging to access loans due to their credit history. Traditional lenders typically require a good credit score and may not consider seniors with limited income as creditworthy. This can leave seniors feeling stuck, as they may need financial support for medical expenses or unexpected bills.

One potential solution that seniors may consider is a no credit loan. But is this option suitable for seniors with limited income? In this section, we explore whether a no credit loan is a viable option for seniors facing financial challenges.

Before deciding whether or not a no credit loan is a viable option for seniors with limited income, it is important to have a clear understanding of what no credit loans are and how they work.

No credit loans are financial solutions that are typically designed for individuals who have poor or no credit history. Unlike traditional loans, which rely heavily on credit scores, no credit loans are based on other factors such as income, employment history, and banking activity.

These loans come in various forms, including payday loans, personal installment loans, and car title loans, and are usually offered by alternative lenders rather than banks or credit unions.

Eligibility for no credit loans may vary by lender, but typically, applicants must meet certain requirements to be considered. These requirements may include:

It is important to note that no credit loans often come with higher interest rates and fees than traditional loans, due to the higher risk involved for the lenders. Borrowers must carefully evaluate the terms and conditions of the loan before accepting.

Despite the potential drawbacks, no credit loans can be a viable option for seniors with limited income who may not qualify for traditional loans due to their credit history. However, it is crucial to understand the pros and cons of such loans and carefully consider all financial solutions available before making a decision.

Seniors with limited income often face a myriad of financial challenges that can make it difficult to access traditional loans. Some of the most common financial hurdles include:

These financial challenges can lead to serious consequences for seniors with limited income, including difficulty accessing healthcare, social isolation, food insecurity, and even homelessness.

Seniors living on a fixed income often face difficult choices when it comes to managing their finances. Balancing basic needs such as housing, food, and healthcare with unexpected expenses can be a daunting task.

For seniors with limited income, a no credit loan can seem like an attractive option. However, before making a decision, it is crucial to carefully evaluate the potential advantages and disadvantages.

Pros:

Cons:

Overall, while a no credit loan can be a viable option for seniors with limited income, it is important to carefully evaluate the pros and cons and consider alternative financial solutions. Effective money management strategies, such as budgeting and reducing expenses, can also help seniors navigate their financial challenges more effectively.

While no credit loans may be an option for seniors with limited income, it’s important to consider alternative financial solutions as well. Here are some alternatives to consider:

It’s crucial to carefully evaluate these alternatives and consider the potential benefits and drawbacks before making a decision. Consulting with a financial advisor or housing counselor can also provide valuable guidance.

Managing finances can be challenging, especially for seniors with limited income. However, with some practical tips and strategies, it is possible to effectively manage your money and plan for the future.

Budgeting: Creating a budget is an essential step in managing finances. Start by listing all sources of income and expenses. This will help you identify areas where you can cut back and save money. Make sure to prioritize essential expenses such as housing, food, and healthcare.

Reducing expenses: There are many ways to reduce expenses, such as using coupons, buying generic brands, and negotiating bills. Consider downsizing your living space or selling unnecessary possessions to free up extra cash.

Seeking financial counseling: Many organizations offer free financial counseling to seniors. Take advantage of these resources to learn about budgeting, debt management, and retirement planning.

Exploring community resources: There are many community resources available to seniors, such as food banks, transportation services, and senior centers. These resources can help reduce expenses and provide social support.

Investing wisely: If you have savings, consider investing in low-risk options such as bonds or mutual funds. Consult with a financial advisor to determine the best investment strategy for your situation.

Planning for the future: It is important to plan for the future, especially as a senior with limited income. Consider options such as downsizing your home, purchasing long-term care insurance, and creating a will.

By following these tips and strategies, seniors with limited income can effectively manage their finances and improve their financial stability. Remember, it is never too late to start taking control of your finances and planning for a better future.

Before making the decision to apply for a no credit loan, it’s important to consider several factors. Firstly, no credit loans often come with higher interest rates and fees compared to traditional loans. Be sure to carefully evaluate the total cost of the loan and whether it’s affordable for your limited income.

Another consideration is the repayment terms of the loan. Some lenders may offer short repayment periods, which can be difficult to manage on a limited income. Look for lenders who offer longer repayment periods with manageable monthly payments.

It’s also vital to be cautious of scams when applying for a no credit loan. Research the lender thoroughly and ensure they are reputable and trustworthy. Be wary of lenders who ask for upfront fees or personal information.

Before applying for any loan, it’s best to explore alternative financial solutions for seniors with limited income. Government assistance programs, reverse mortgages, and low-income housing options may be more suitable options for some seniors.

Overall, carefully considering your financial situation and exploring all available options can help you make an informed decision when it comes to applying for a no credit loan or any other financial solution.

In conclusion, seniors with limited income may find themselves in a challenging financial situation. No credit loans may seem like a favorable option, but it is important to evaluate the pros and cons before making a decision.

Consider alternatives: There are alternative financial solutions available, such as government assistance programs, reverse mortgages, and low-income housing options, which seniors should explore before committing to a no credit loan.

Effective money management: Seniors can also manage their finances more effectively by implementing practical tips and strategies, including budgeting, reducing expenses, and seeking financial counseling.

Be cautious: Before applying for a no credit loan, seniors should be aware of potential scams and carefully evaluate the interest rates and repayment terms.

In summary, seniors with limited income should take the time to assess their financial situation comprehensively and explore various options before committing to a no credit loan. Effective money management and cautious financial decisions can help seniors navigate their financial challenges more effectively.